Accounting can be a complex and confusing field for many people, especially those who are not familiar with the terminology used in the industry. To help you navigate the world of accounting, here is a list of common accounting terms that you may come across.

Whether you are a business owner, a student studying accounting, or simply interested in learning more about finance, having a basic understanding of these terms can be beneficial in various aspects of your life.

List of Accounting Terms:

- Assets

- Liabilities

- Equity

- Income Statement

- Balance Sheet

- Cash Flow Statement

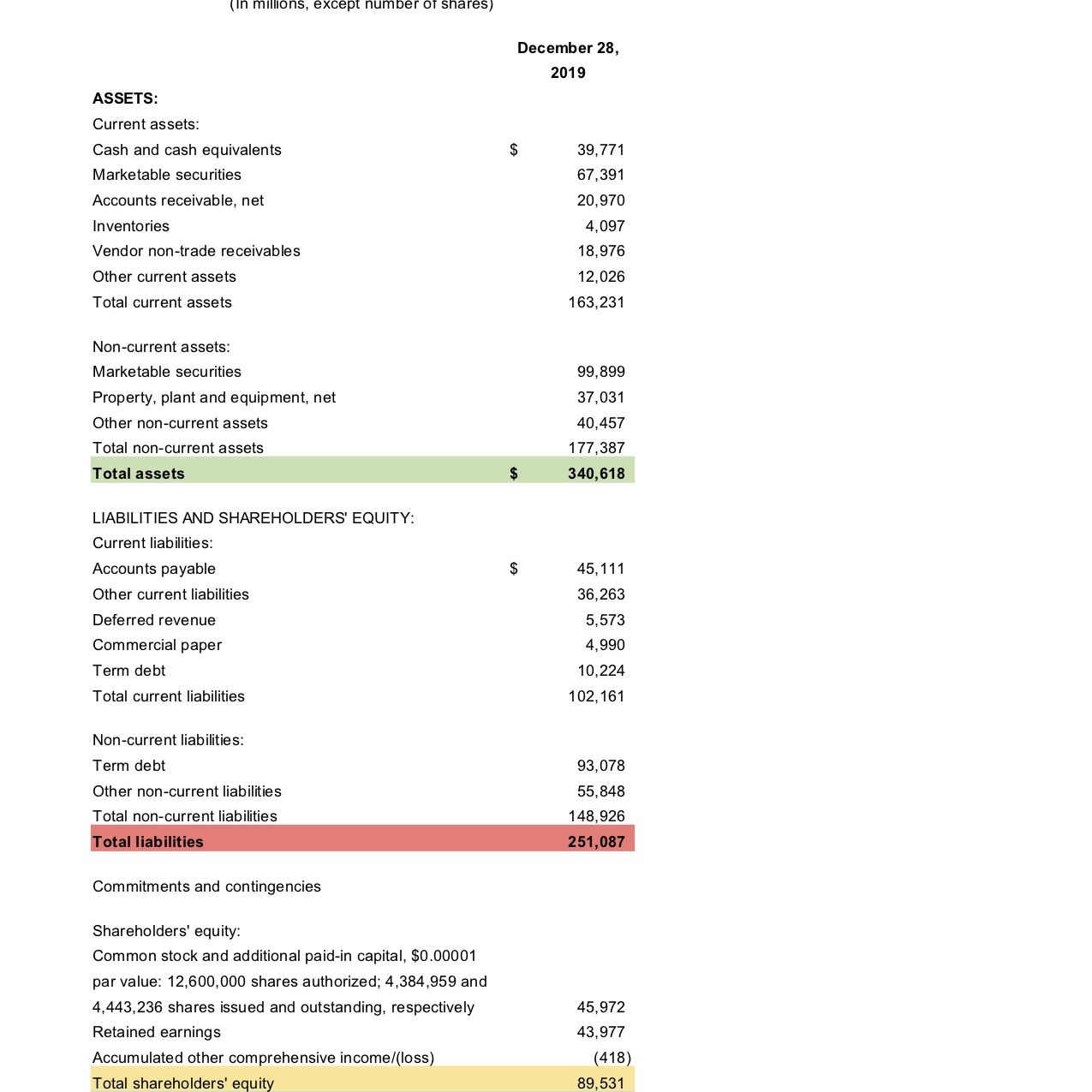

Assets: Assets are resources owned by a company that have economic value and can be used to generate future economic benefits.

Liabilities: Liabilities are obligations that a company owes to external parties, such as creditors or suppliers.

Equity: Equity represents the ownership interest in a company’s assets after deducting its liabilities.

Income Statement: An income statement, also known as a profit and loss statement, shows a company’s revenues, expenses, and profits or losses over a specific period.

Balance Sheet: A balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

Cash Flow Statement: A cash flow statement tracks the flow of cash in and out of a company, showing how changes in balance sheet accounts and income affect its cash position.

By familiarizing yourself with these accounting terms, you can gain a better understanding of financial reports, make more informed business decisions, and communicate effectively with accounting professionals.

Whether you are a beginner in the world of accounting or looking to refresh your knowledge, having a grasp of these fundamental terms can help you navigate the complexities of the financial world with confidence.